Negative Rates Hit Global Shipping Market

Negative Rates Hit Global Shipping Market

The owner of the world’s biggest shipping line says negative interest rates are hurting the industry by delaying the consolidation wave so badly needed.

The monetary policy environment “means that consolidation will be much slower because it’s easy for banks to keep weak shipping companies above water,” Nils Smedegaard Andersen, chief executive officer of A.P. Moeller-Maersk A/S, said in an interview.

It’s the latest example of how negative interest rates are distorting markets and potentially even slowing growth. The policy has so far had limited success in reviving inflation while money managers in countries with negative rates are warning of the risk of asset price bubbles. With the unintended consequences potentially including a slower global shipping recovery, questions as to the policy’s efficacy are bound to persist.

“Politicians aren’t making the reforms that are needed and are leaving it to the monetary policy makers to solve the economic problems that many countries face with low competitiveness and low investment levels,” Andersen said. A reliance on cheap finance in container shipping has led to “many negative effects,” he said.

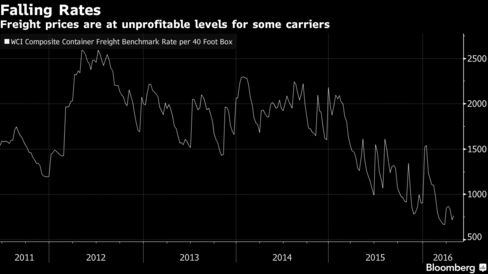

The shipping industry doesn’t have the buffers to deal with more hurdles. Container lines are “staring at a terrible 2016,” with a slowdown in global trade volumes, low freight rates and overcapacity, Drewry Maritime Equity Research said in a report last month. It estimates the industry will lose $6 billion this year.

Hanjin Shipping Co., South Korea’s biggest container carrier and the world’s no. 8, is in the middle of a debt restructuring. Its banks on Wednesday agreed on the terms on condition that all creditors, including corporate bond holders, join the plan.

Global shipping lines are increasingly forming alliances to help cut costs and underpin freight rates. Last month, CMA CGM SA and three other major lines signed a preliminary agreement to form a new group called Ocean Alliance, which could become the second biggest after Maersk Line’s partnership with Mediterranean Shipping Co.

“We’re satisfied with our current position within our alliance,” Andersen said.

“But if a container line were to come up for sale -- with the right profile and also at the right price -- we would consider it. We are, after all, businessmen.”

Meanwhile, the era of extreme monetary stimulus looks set to continue. A growing number of central banks from Sweden to Japan have resorted to negative interest rates in an effort to revive lending and growth. Maersk’s home-country of Denmark has the world record in negative rates after hovering below zero for the better part of four years.

“The negative interest rates are unhealthy symptoms and can lead to bubbles,” Andersen said.

Source : http://www.bloomberg.com/news/articles/2016-05-08/negative-rates-hit-global-shipping-market-as-zombies-slow-m-a

- By admin

- 17 Jun 2016

- 2361

- INSA